Report by Engineering Post

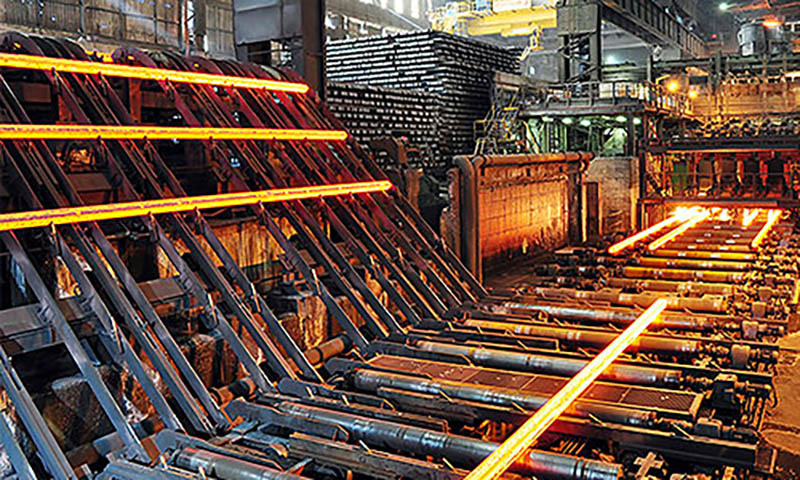

The Competition Commission of Pakistan (CCP) has undertaken “Competition Assessment Study of the Steel Sector of Pakistan” and warned that the country’s steel industry is idled with systemic inefficiencies, widespread tax evasion, cartel , and weak regulatory oversight, and called for urgent policy reforms and the creation of a dedicated Ministry of Steel at the federal level to address structural distortions.

The CCP has as such painted a somewhat troubling picture of one of the country’s most critical industrial sectors , which contributes nearly 1.4 percent to gross Domestic Product (GDP) and e employs over half a million people but remains quite heavily undocumented, import-dependent, and policy fragmented..

The CCP’s report has underlined bitterly that despite Pakistan’s total steel production reaching 8.4 million metric tons (MT) in FY2, including 4.9 million MT of long steel and 3.5 million MT of flat steel, the country’s per capita steel consumption in just 47 kilometer which is far below regional peers, thereby indicating rather sluggish industrial and infrastructure growth.

According to the CCP’s report, the manufacturing sector contributes about 71 percent of total exports and roughly employs 15 percent of the national work force, with steel forming a vital component of the value chain. However, years of inconsistent regulation, weak enforcement, and fragmented policy making have stunted the sector’s growth. Furthermore, the substandard steel constitutes nearly 60 percent of domestic output, largely due to weak implementation by the relevant authorities and an ineffective standards regime.

It was noted in the CCP’s report that Pakistan Steel Mills (PSM), which was once a strategic national asset with an annual capacity of 1.1 million tons has since been non-operational since 2015, burdened with Rs 400 billion in liabilities. Its collapse has left the market reliant on private units and steel scrap imports, which stood at 2.7 million MT in FY24 exposing local prices to global fluctuations and foreign exchange shocks.

The report as such has called for comprehensive reforms, formulation of a National Steel Policy and establishing a dedicated Steel Ministry by the federal government for coordinating policy, regulation, and industrial development. The CCP through its report has also urged the federal government to ensure the rationalization of taxes, stabilization of Statutory Regulation Orders (SROs), strict enforcement of quality standards, and integration of undocumented units into the formal economy.

The CCP has also proposed incentivizing Direct Reduced Iron technology, developing local iron ore reserves, and promoting green, energy-efficient production technologies. It has also been recommended that the Committee on ease of Doing Business should be expanded to include industry experts and CCP representatives alongside strengthening the National Tariff Commission for ensuring timely responses to dumping and import surges.

The report has concluded by saying that unless the federal government acts swiftly to address structural flaws, Pakistan’s steel industry will continue to face high construction costs, uneven competition, and limited export potential.